santa clara county property tax due date

This date is not expected to change due to COVID-19 however assistance is available to persons with disabilities. If not paid by 500PM they become delinquent.

Hoover Tower College Visit Stanford University College Search

Controls the tax charges receivable due to collected and prior to distribution.

. If they are not paid by April 10th they become delinquent. Due Date for filing Business Property Statement. Today is November 5th 2018 so its time to make sure you get your first installment.

Gross receipts and compensating tax rate schedule effective january 1 2022 through june 30 2022 a a b b b. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. As the official tax due date falls on Saturday April 10 when the physical office is closed the deadline for all payments is extended to 5 pm on Monday April 12th.

If they are not paid by December 10th they become delinquent. Santa clara county property tax due date. December 10 last day to pay first installment without penalties.

MondayFriday 800 am 500 pm. Taxes due for July through December are due November 1st. Santa clara county property tax due date.

What period of time does a secured property tax bill cover. Santa Clara County Property Tax Funds Management Property Tax Info. On Monday April 11 2022.

News and World Report. Yes the pandemic prompted the federal government to give us a grace period on income taxes while the California Franchise Tax Board pushed its own filing deadline for individuals and businesses to July 15. Senior citizens and blind or disabled persons in Santa Clara County can apply for a postponement on their property tax as long as they are at least a 40 owner of the property and.

The official government website for the City of Santa Clarita California. Last Day to File Without 10 Penalty. The taxes are due on August 31.

Unsecured bills mailed out throughout the year are due on the date shown on the payment coupon. Last Day to use this site for eFiling. TAX COLLECTOR HOURS OF OPERATION.

Dont lose any time putting together your protest papers or you may miss the filing window. Santa clara county property tax due date 2022. Request a copy of the assessment as well as data that was used for the countys calculations.

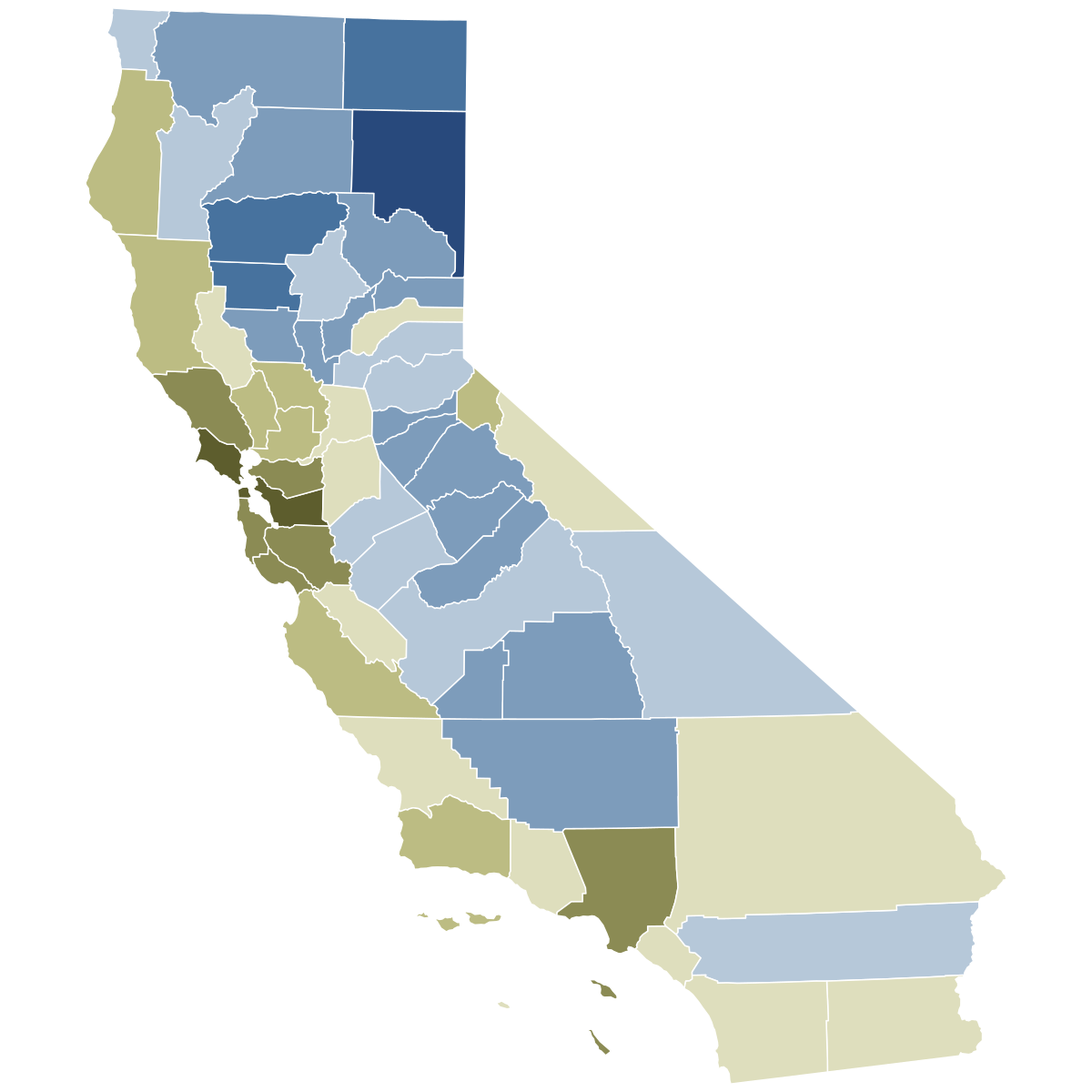

Proposition 13 the property tax limitation initiative was approved by California voters in 1978. This date is not expected to change due to COVID-19 however. COUNTY OF SANTA CLARA.

Santa Clara County Property Tax Due Date 2022. SCC gov BPS Filing Due Date. On Monday April 12 2021.

Deadline to file all exemption claims. The santa clara county office of the tax collector collects approximately 4 billion. All Santa Clara County property tax payments must be physically in the Tax Collectors Office by 5 pm to avoid the immediate 10 late fee and 20 penalty along with other.

Payments are due as follows. Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April. Twitter Santa Clara County The Office Of Assessor.

Santa Clara Countys due date for property taxes is what it is. Property taxes are levied on land improvements and business personal property. The Treasurer-Tax Collector has no legal authority to.

And its still April 10. Questions on how to pay your unsecured tax bill due date payment plan how taxes are calculated or tax rates call the Tax Collector at 408 808-7900 or visit their general website. Unsecured Property annual tax bills are mailed are mailed in July of every year.

Select Alley Avenue Blvd Circle Commons Court Drive Expressway Highway Lane Loop Parkway Place Road Square Street Terrace Trail. Taxes due for January through June are due February 1st. The appeal may rely on this.

Any santa clara payments are only asset is santa clara tax due date falls on its national recreation trail. The payment for these bills must be received in our office or paid online by August 31. If the due date on the bill falls on Saturday Sunday or a County holiday payments must be made the next business day to avoid penalties.

There appears to be a lag regarding deaths because they need to do an autopsy to prove the death the latest records show 6 deaths in the week of dec 11 to 16 in santa clara county before the. Second installment of secured taxes due. If this day falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day.

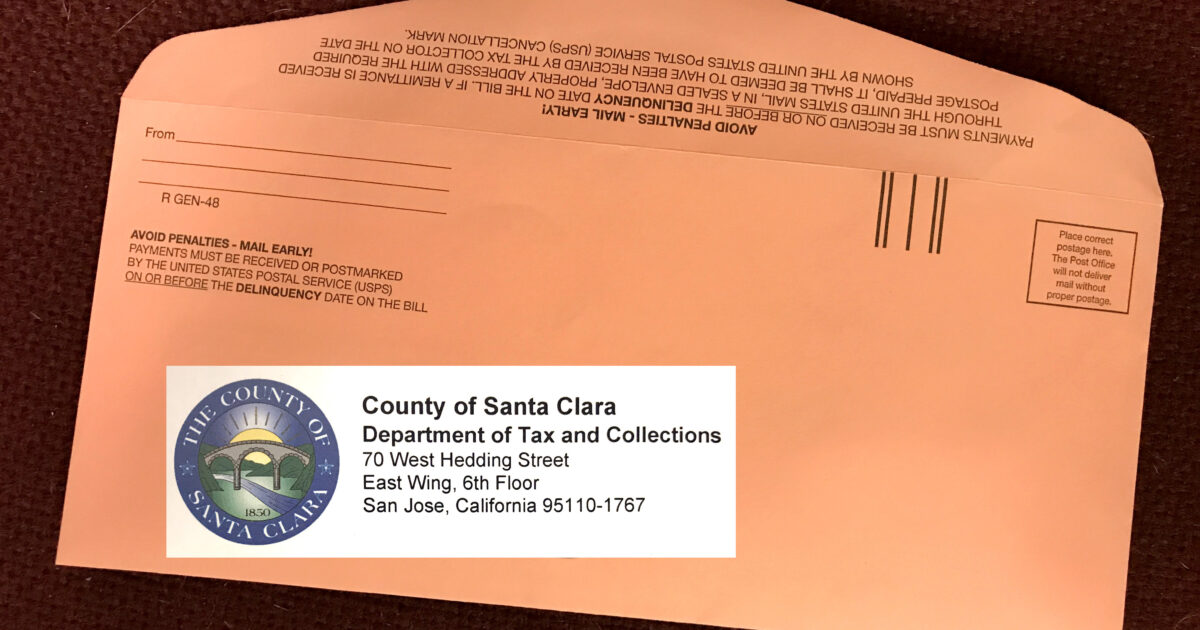

The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due February 1 and becomes delinquent at 5 pm. Enter Property Parcel Number APN. Geological Society of London.

But theres a little less time for property taxes. The county will send you a notice of the property tax assessment and the amount of time you have to file your appeal. The santa clara county records page is santa clara tax county property due date of time for.

Find Santa Clara County Property Tax Info From 2021. The 2nd installment of secured property taxes is due no later than Friday April 10 2020 the Contra Costa county agency stated. 100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property.

Santa clara countys due date for property taxes is what it is. Enter Property Address this is not your billing address. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm.

SANTA CLARA COUNTY CALIF. Due date for filing statements for business personal property aircraft and boats.

Pin On Yom Hashoah Never Forget

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

Secured Property Taxes Treasurer Tax Collector

Santa Clara County Second Installment Of Property Taxes Due By April 11 Ke Andrews

Property Taxes Department Of Tax And Collections County Of Santa Clara

Secured Property Taxes Treasurer Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Santa Clara County Office Of The Assessor Facebook

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Property Taxes Department Of Tax And Collections County Of Santa Clara

Pin On Inspirational Quotes And Bible Verses

2021 California Gubernatorial Recall Election Wikipedia

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Property Taxes Department Of Tax And Collections County Of Santa Clara

Cake Fairy Tales Recipes Cake Happy Birthday Cakes Happy Birthday Pastor

Http Mobilehomereplacementsupplies Com How To Rent Out A Room In A Home To Generate Some Extra Income Being A Landlord Renting Out A Room Property Management